ACCTG403:

Lesson 1: Course Expectations and Research

Auditing – A Preface to the Course

This preface lesson is designed to review some basic accounting concepts, present resources for research, and reinforce a few topics that apply across the accounting discipline. Auditing is as much an attitude as it is a process, and students are not always prepared to learn about auditing. No one explains this concept when you are registering for the course! This lesson is designed to provide the framework necessary to develop the mindset of an auditor. I make no assumptions about students; I do, however, have expectations. I expect:

- A positive attitude.

- Honesty! Be honest with me, and more importantly, be honest with yourself. I do not know what you expect from this course, and only you can determine that.

- Commitment to learning. I do not know what you know or don't know. You may need to work a little harder in some areas. I am asking you to make the commitment.

- Acceptance that auditing has a purpose beyond a requirement for your degree. I like to think the auditor is trained to see things a little differently. This visionary quality will serve you well in any profession and in life. It is yours for the taking.

Your prior accounting courses have taught to think analytically and speak “accountantese,” the language of accounting and business. This course will help you learn “auditese,” the language of auditing. You will learn to think like an auditor, even more analytically than before. Your perspective changes from simply learning the accounting process to reviewing and auditing the accounting process.

Lesson 1 Objectives

After completing this lesson you should be able to do the following:

- Access the online Penn State University Library system and RIA Checkpoint Database.

- Recall the fundamental mechanics of accounting, including GAAP, steps in the accounting process, and standard accounting records.

- Define corporate governance and agency theory.

Lesson Readings & Activities

By the end of this lesson, make sure you have completed the readings and activities found in the Lesson 1 Course Schedule.

A Little Review Never Hurts!

It would be easy to assume that you are positively brilliant at the mechanics of accounting; the design and operation of an accounting system; and the proper application of generally accepted accounting principles GAAP. However, as auditors, we never assume.

Your first lesson in auditing begins with a review of financial accounting. We do this because the financial statements and the related disclosures are the focus of the financial statement audit. Financial accounting is the process responsible for the preparation of the financial statements and related disclosures.

There is another purpose to this particular lesson. Many of you will be graduating this semester. That means you will be going to interviews. Your potential employers will expect you to know this stuff. Our hope is that part of this lesson will help you feel better prepared, confident, and be very impressive when interviewing.

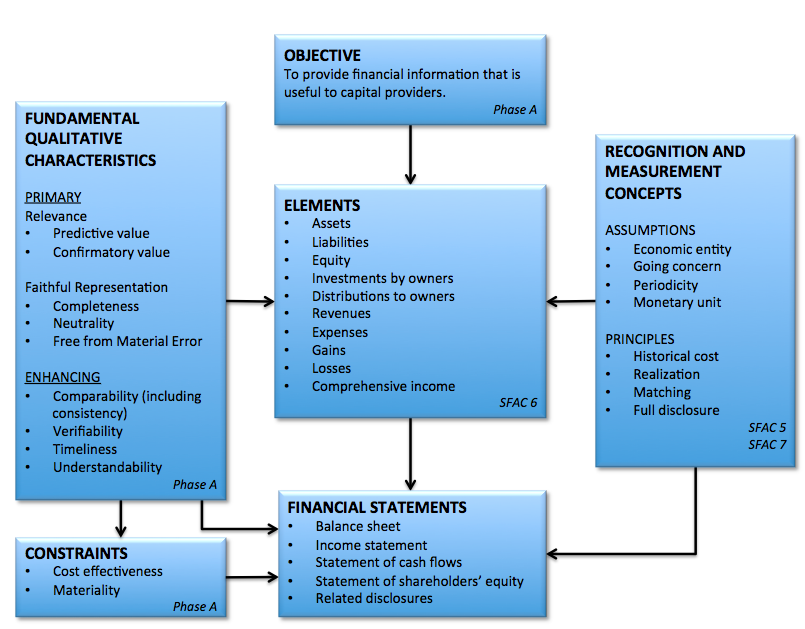

We refer to the financial statements and related disclosures throughout the course, so let's begin by visiting the GAAP based framework used for financial reporting, shown in Exhibit 1.

Exhibit 1: GAAP Framework

The size of the company does not matter. Whether the audit is performed on a Fortune 100 company or small business, the company is expected to prepare their financial statements using this framework. The audit process is designed to test for adherence to these GAAP concepts and promulgated standards. Failure to following the Historical Cost Principle is a departure from GAAP. The financial statements would not present fairly the results of operations, the income statement or financial position, or the balance sheet for the year.

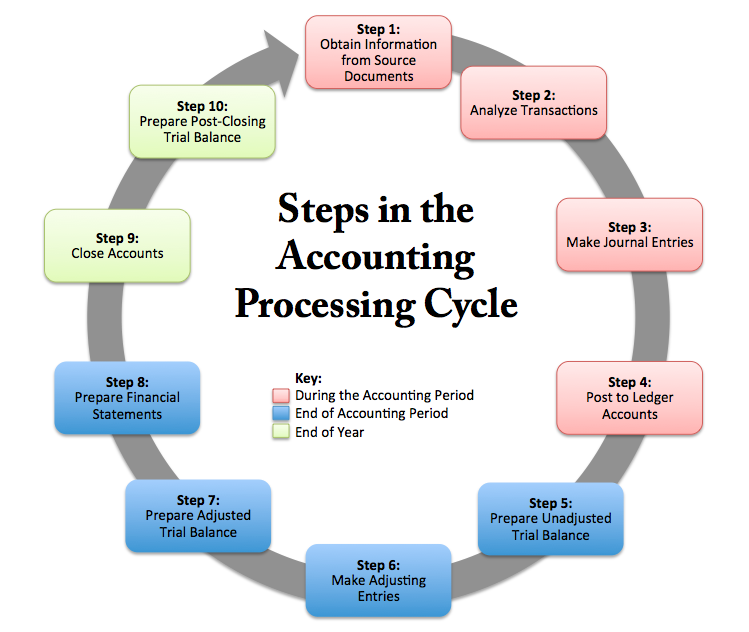

Steps in the Accounting Process, Adjusting Entries, and Errors

Next, the steps of the accounting processing cycle, shown in Exhibit 2, are the systems used to ensure that transactions are properly recorded. We will test this process during the audit, as well as the related system of internal control associated with the process.

Exhibit 2. Steps in the Accounting Processing Cycle

Exhibit 3 serves as a reminder of the formal link between the income statement accounts and the balance sheet accounts. Notice the effects, as indicated by the arrows, can be direct or indirect.

Exhibit 3. Adjusting Entries

We express the impact of a misstatement (error) in the accounting records in terms of an overstatement or understatement. I suggest that you adopt this method of analysis and expression. Experience has shown that it helps students apply the auditing concepts and procedures more easily and completely.

Exhibit 4 is an example of an error. The 2010 Ending Inventory overstates net income. Exhibit 4 shows the error corrects itself in 2011. This is unacceptable for audit purposes.

Audit procedures are specifically designed to identify this type of error, determine the circumstances, intentional or unintentional, that allowed the misstatement to occur and propose the audit adjusting journal entry to the company that would correct net income for 2010. Without the correction, 2010 net income would be overstated.

Exhibit 4. Inventory Misstatement Example

|

The SitTite Chair Company uses a periodic inventory system. A mathematical error in 2010 caused a $250,000 overstatement of the ending inventory. However, future inventories were correctly calculated. The proper course of action for correcting this error depends on when the error was discovered. The figures below, which ignore income tax, show the effects of the error if discovered after 2011. In each instance, the overstated and understated amounts are $250,000. Analysis: U= Understated O = Overstated |

|||

| 2010 | 2011 | ||

|

Beginning inventory Retained earnings |

|

Beginning inventory Retained earnings | O - $250,000 O - $250,000 O - $250,000 U - $250,000 corrected |

Accounting Records and Reports

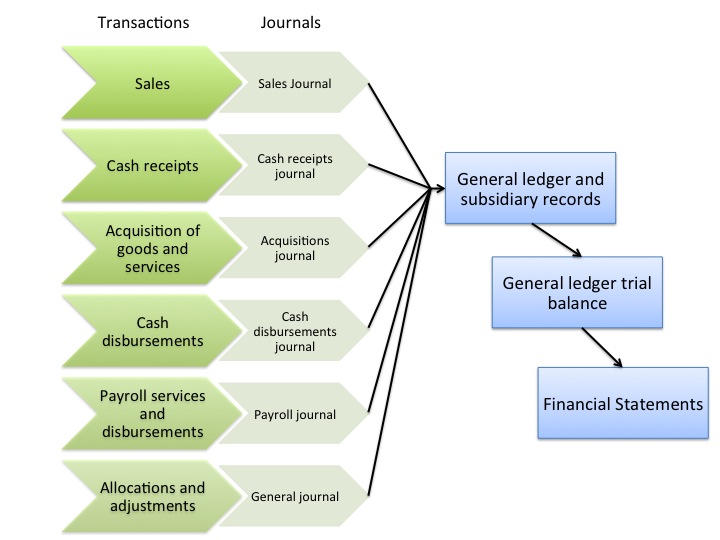

Our review would not be complete without mentioning the accounting records and reports. Exhibit 5 presents the flow of transactions through the accounting process and the various reports (journals, ledgers and trial balance) that are part of the accounting system.

I suggest that as you are reading the text and view the lessons that you stop and try to apply the concept as if you were recording the transaction.

Exhibit 5. Flow of Accounting Transactions

Consider a simple sales transaction.

|

Date |

Account |

|

Dr |

Cr |

|

|

??????? |

|

$20,000.00 |

|

|

|

Sales |

|

|

$20,000.00 |

What account should be debited? Cash (my favorite account) or accounts receivable.

This transaction is the same for any sale. I am not saying that you did not know how to record the transaction. I am suggesting that you will use this simple process when dealing with more complex issues. Remember, keep it simple. Think in terms of journal entries and “T” accounts.

A fictitious entry would be recorded the same way, only the perpetrator would not use the cash. You cannot fake cash. They may attempt to hide the entry in accounts receivables or debit some other asset account.

Which reports would you use to try and locate the fictitious entry? Use Exhibit 5 to formulate your answer. (sales journal, account receivable subsidiary ledger and accounts receivable aging report) Oh, I forgot to tell you that the company is Amazon and they process about 13.3 sales transactions per second!

Never forget the mechanics of accounting. It will always serve you well.

Research

In accounting, research is an important part of what we do. We research proper application of accounting pronouncements, tax codes and related regulations, and auditing standards to name a few.

Auditing is now completed according to GAAS (Generally Accepted Auditing Standards). Where do you go to find GAAS? Try the RIA Checkpoint (Business) below to locate them through the Penn State Library.

RIA Checkpoint Business Activity

Go to the Penn State Library Accounting Resources. Follow the steps below to locate and explore GAAS.

- Click on RIA Checkpoint (Business: AICPA and FASB).

- Under the dropdown selector, choose “Acctg, Audit & Corp Finance.”

- Click on “Table of Contents” in the menu directly above the dropdown selector.

- Expand the “+” at “Accounting, Audit & Corporate Finance Library.”

- Expand the “+” at “Standards and Regulations.”

- Expand the “+” at “AICPA.”

- Expand the “+” at PCAOB.

- Peruse the content under each of those topics.

- Expand the “+” at the AICPA “Professional Standards.” Notice that there are “US Auditing Standards” and “US Auditing Standards – AICPA Clarified.”

Our class will focus on the clarified U.S. auditing standards because the clarified standards took effect January 1, 2013. The clarified standards represent a codification of previously existing standards plus some changes to have a higher degree of coordination with international standards. - Check out what else is available under “Professional Standards” – Attestation, Review and Compilation, Tax, etc. This is where you have access to applicable assurance standards and FASB pronouncements.

- Please take note that Statement of Auditing Standards (“SAS”) No. 122 is the final SAS that actually codifies the clarified standards. SAS 122 is a 334 page document that explains the rationale behind the codification and clarification project and that statement also provides you with a cross-reference from the old SAS to the new clarified standards.

- Take a moment to read AU-C Section 200 paragraphs .04 through .10 to read what an audit of financial statements means. Pay specific attention to the discussion on materiality in paragraph .07. Note the footnote at the end of the statement on materiality. If you look below for the footnote, you’ll find a hyperlink to AU Section 320 “Materiality in Planning and Performing an Audit.” Read paragraph .12 and .13 to understand the overall objectives of the auditor.

We will utilize these standards throughout the course, so you are strongly encouraged to save the library page as a resource for future activities and assignments. Other courses in this program have introduced you to the Accounting resources through the Library as well, so please take this opportunity to refresh your memory and revisit the tools and databases at your disposal.

What Is Corporate Governance, and Why Is It Important?

I present corporate governance now because I want to expose you to the topic even before we start. Corporate governance is referred to throughout this course and extensively in the auditing standards. DO NOT endow the board of directors or a company’s senior management with traits of honesty, trustworthiness or high ethical standards. Auditors never assume. An auditor expects these qualities to be present; however the audit procedures require us to substantiate the facts. We need proof. The auditor finds evidence that confirms or denies the existence of these qualities.

The concept of corporate governance has been evolving over time. The OECD Principles of Corporate Governance states:

"Corporate governance involves a set of relationships between a company’s management, its board, its shareholders and other stakeholders. Corporate governance also provides the structure through which the objectives of the company are set, and the means of attaining those objectives and monitoring performance are determined."

You can’t discuss corporate governance without a mention of “agency theory.” The officers of the company act as agents for the shareholder according to agency theory. In other words, the officers have jobs in order to maximize the shareholder’s wealth. All activities of the company should be directed at that sole purpose. True?

In general, the officers should be focused on maximizing shareholder wealth. But other stakeholders exist to which the corporation is accountable, such as:

- External auditors

- Government regulators

- Society

- Employees

- Customers

- Vendors

So what is the due and appropriate role of business? Consider Milton Friedman’s (noted conservative economist) view of social responsibility: “There is one and only one social responsibility of business – to use its resources and engage in activities designed to increase its profits so long as it stays within the rules of the game, which is to say, engages in open and free competition without deception and fraud."

Elements of Governance

Governance covers some big territory. Most certainly it includes the agency theory that we previously discussed. What are some of the other elements of governance to consider? How about a code of ethics for an organization? How do Boards of Directors establish expectations for corporate behavior, communicate those standards to stakeholders, and enforce those standards? Dentsply International has published a good example of their corporate ethics.

As this course is being written, the U.S. is in the midst of a protracted recession that began in 2008. The 2008 recession was a “bubble” - a real estate lending bubble. Mortgage lenders and their financiers pulled some fast ones, such as:

- Giving out mortgages to people who didn’t warrant the credit.

- Giving mortgages to dual income couples that required the income of both to make the payments (with a divorce rate of 50%, how likely was a problem with, oh, about half of those mortgages).

- Creating accumulations of those stinky mortgages as “collateralized mortgage obligations or “CMOs” and sold them in the security markets.

It was a different bubble that popped at the turn of the millenium. Enron was one of the best places to work year after year. That “successful” energy trading company was in fact a house of cards whose demise also brought down their auditor, Arthur Andersen. Check out the analysis from the Journal of Criminal Law and Criminology from ProQuest (using the Penn State Library links we just explored). As a result of these activities, we ended up with the Sarbanes Oxley Act of 2002. We’ll talk more about that statute later.

My hope is that you’ll see that strong governance IS IMPORTANT. Good governance can help create a distinct competitive advantage like what Dentsply enjoys. Ineffective governance structures can literally put an organization out of business.

Summary

I am never sure where my students will begin their accounting careers. I do know that most of the topics presented in this course will present themselves to you during your professional career in accounting. Therefore, I offer this one piece of advice regarding this course: Be passionate about auditing.