ACCTG472:

Lesson 1: Course Orientation and Review of Accounting Cycle

Introduction

This course is a continuation of Intermediate Accounting I and provides students with an in depth look at generally accepted accounting principles and procedures so that they properly account for and present information in financial statements prepared for external users. Topics covered in this course include: revenue recognition, current liabilities and contingencies, long-term liabilities, investments, leases, pensions, income taxes, shareholders’ equity, taxes, earnings per share and the statement of cash flows.

For this week’s lesson we will be reviewing the various component parts of the Accounting Cycle and the Accounting Information System. The information is this lesson was covered in detail in ACCTG 211 and ACCTG 471.

We will start off by gaining an understanding of basic accounting terminology, including an explanation of the double-entry rules of accounting. Next we will identify and discuss the steps that make up the accounting cycle. We will then cover how to record transactions in the general journal, how to post entries to the respective ledger accounts, and review the preparation of a trial balance.

Further, our lesson for this week will identify and explain the reasons for preparing adjusting entries, discuss how to prepare the various financial statements from the “adjusted” trial balance, and discuss the rationale for preparing period end closing entries.

Learning Objectives

At the end of this lesson, you will be able to do the following:

- review basic accounting terminology;

- explain the double-entry rules of accounting;

- define, interpret, and learn the basic steps in the accounting cycle;

- review and practice how to record transactions in journals, post to general ledger accounts, and prepare a trial balance;

- explain and understand the purpose and procedures for preparing adjusting journal entries;

- prepare, interpret, and analyze how to prepare financial statements from the adjusted trial balance; and

- review and understand how to prepare period-end closing entries.

Lesson Readings & Activities

By the end of this lesson, make sure you have completed the readings and activities found in the Lesson 1 Course Schedule.

Double-Entry Accounting System

The double-entry system is a universally used system in accounting to ensure that debits equal credits. For every transaction that occurs, a company must record the two-sided effect of each, identifying the appropriate general ledger accounts affected. The double-entry system also serves a check-and-balance to ensure the accuracy of the records transaction amounts. If a company records every transaction with the equal number of debits and credits as it should, then the sum of the debit entries to all of accounts must, by rule, equal the sum of all of the credit entries.

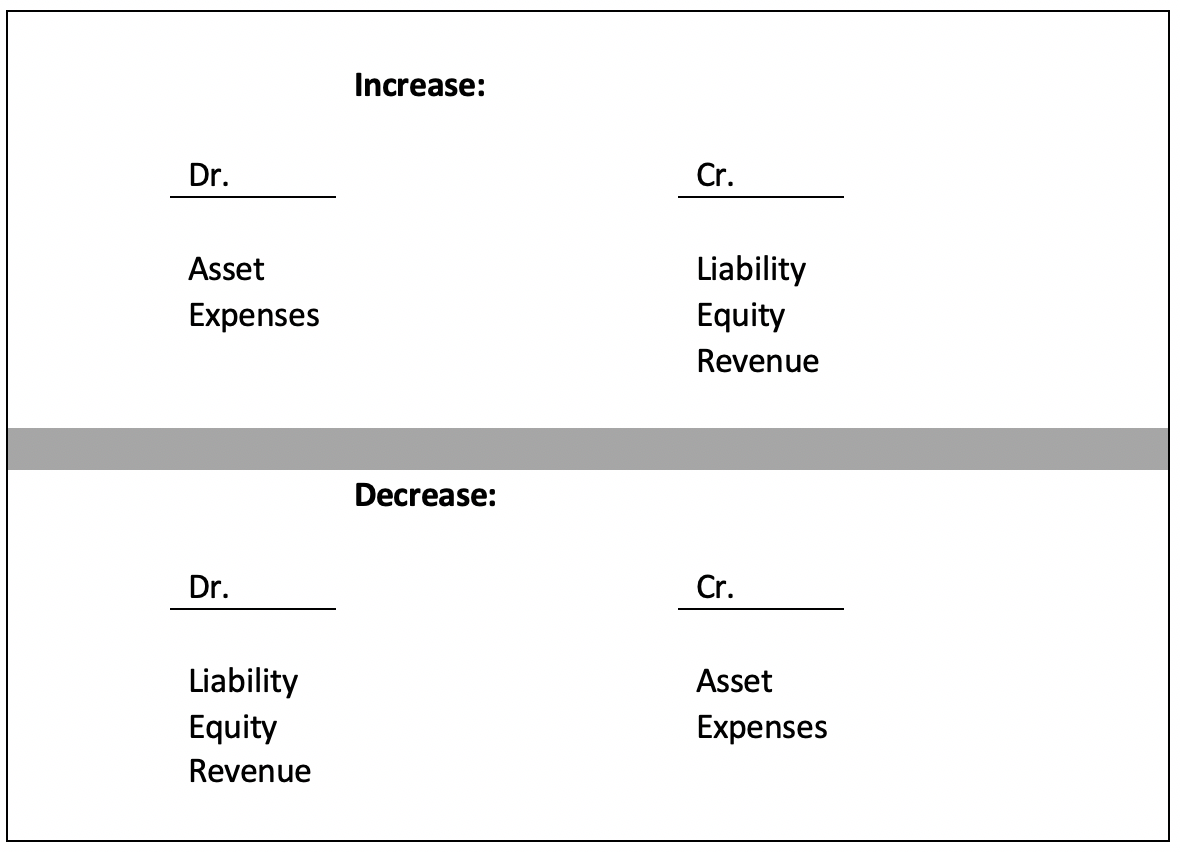

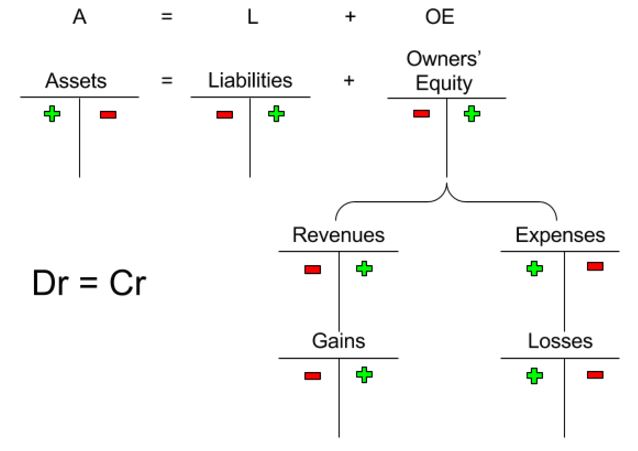

As shown on the illustrative example, there are certain specific rules that must be followed that are the foundation for the double-entry system.

- Increases in all asset and expense accounts are recorded on the left (or debit) side, and decreases in those same accounts on the right (or credit) side.

- On the other hand, increases in all liability and revenue accounts are recorded on the right (or credit) side, and decreases on the left (or debit) side.

Transactions affecting stockholders' equity will also be recorded in a similar manner.

- Increases to equity accounts, such as Common Stock and Retained earnings, are recorded on the credit side, while increases to Dividends are recorded on the debit side.

Double-Entry (Debit and Credit) Accounting System Self-Check Activity

Consider what the double entry should look like in a t-account. Then click on the Show Entry link to check your answers.

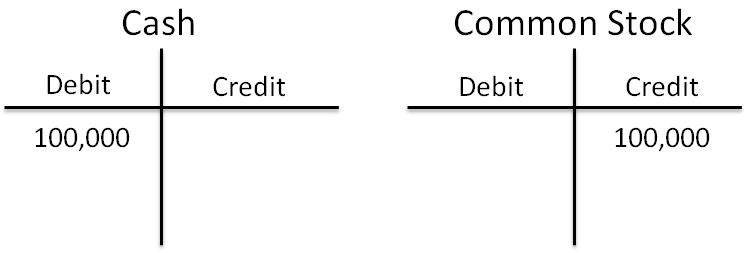

1. Owners invest $100,000 in the corporate form of a business. (Show Entry)

An investment of cash in a business represents an increase (or debit) to the company's cash balance. In return, the owners receive stock (or ownership) in the business for their investment.

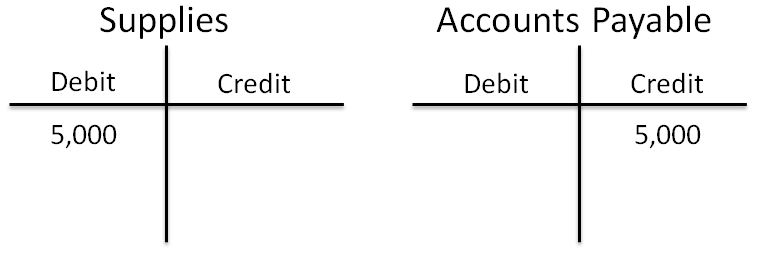

2. Company purchased $5,000 of supplies on account (Show Entry)

The purchase of supplies represents an asset to the company and does not become an expense until the supplies are used or consumed in the business. The asset account Supplies is increased, and since the supplies have not been paid for as yet, a credit (or increase) to the liability account is shown.

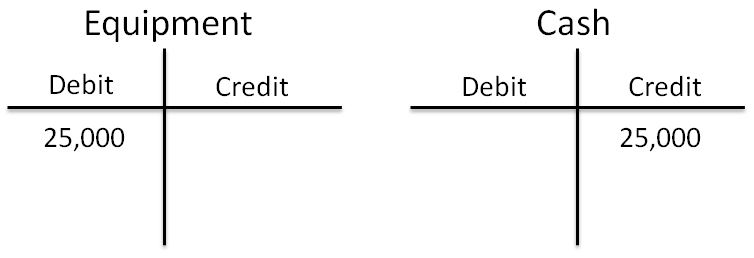

3. Purchased equipment in the amount of $25,000 for cash (Show Entry)

Equipment represents a long-term asset of the company. So when equipment is acquired, the asset account increases. Since the equipment was purchased for cash, the asset account Cash is decreased. This is an example of a transaction that only affects one side of the accounting equation (the asset side). However, equality of the transaction must still exist.

4. Rendered services for $15,000 cash (Show Entry)

Since the company has received cash, the asset account Cash is increased and the revenue account, which indirectly flows through stockholders' equity, is credited.

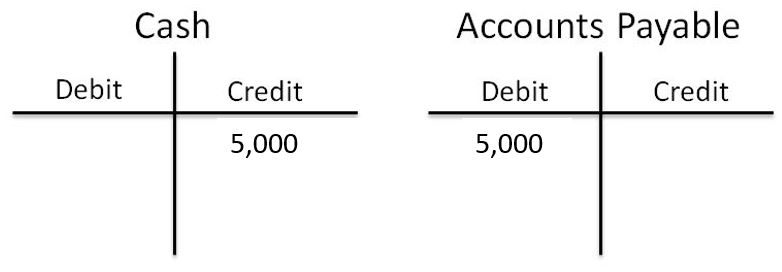

5. Paid vendor for supplies purchased in Problem 2 (above) (Show Entry)

Since the company has paid the vendor with cash for supplies that were previously purchased on account, the asset account Cash is decreased. In addition, the liability account Accounts Payable is also decreased (or debited) since the supplies that were purchased in Transaction 2 have been paid for in full. It should be noted that the balance in the Accounts Payable account is now zero.

The Accounting Equation

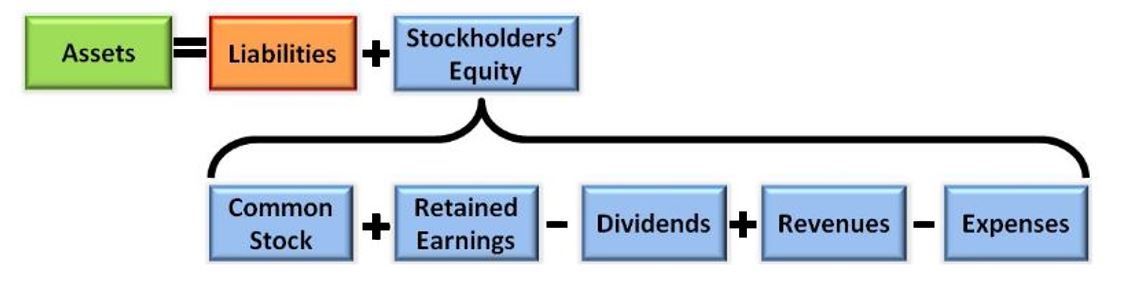

The basic accounting is represented by:

All transactions must either directly or indirectly flow through this equation. The foundation for the double-entry system of accounting is that for every debit there must be a credit, and for every credit there must be a debit. However, it should be noted that it is possible for a transaction to only affect either the left-hand side of the equation or only the right-hand side.

The above equation can be expanded to show the accounts that flow through stockholders' equity.

Journalization Process

A company records in "accounts" all transactions that impact asset, liability, and stockholders' equity accounts. The company's general ledger contains all of the asset, liability, and stockholders' equity accounts that have a balance. Companies typically do not record transactions directly into the ledger. Instead, transactions are formally recorded in the general journal. This process is often referred to as journalizing.

Example Exercise - recall from Accounting 471

Look at the transactions below and then reveal how each of the 11 transactions are journalized.

|

-

| December |

-

|

| 1 | 1 | Owners invest $100,000 into the company |

| 2 | 1 | Purchased a 6 month Insurance Policy in advance for $2,400 |

| 3 | 1 | Company purchases $50,000 worth of equipment, paying $10,000 cash and the rest on a 5% note |

| 4 | 3 | Company purchases supplies on account for $4,000 |

| 5 | 5 | Purchased a truck for cash $20,000 |

| 6 | 8 | Provided service on account $10,000 |

| 7 | 15 | Received $2,000 on account from transaction 6 |

| 8 | 20 | Paid $2,000 on account from transaction 3 |

| 9 | 23 | Provided service and received cash $5,000 |

| 10 | 23 | Received $10,000 advanced payment for services to be rendered in the future |

| 11 | 28 | Paid Electric Bill $500 |

Posting

Posting is the process of transferring journal entries to the individual ledger accounts. A typical ledger follows a standard format that includes

- dates

- transaction numbers and

- debit/credit amounts transferred from the general journal.

When we talk about posting, we're talking about the process of simply taking the journal entries that we just prepared and placing them into the individual ledger accounts. Each account, whether it's an asset, liability, or owner's equity account, will be kept track of in T accounts. As a reminder debits are on the left and credits are on the right. The first thing we'll list is the transaction number from the general journal in parentheses, and then the amount that was debited or credited.

If we look at the cash ledger account in our example, the first journal entry involves this account. So we will put a one in parentheses, then the debit amount of $100,000. After all the transactions are posted, then we will tabulate the amounts to get the balances of each account, which will be used for the next step in the process.

|

debit transaction number

| DR | CR |

credit transaction number

|

|---|---|---|---|

| (1) | $100,000 | $ 2,400 | (2) |

| (7) | 2,000 | 10,000 | (3) |

| (9) | 5,000 | 20,000 | (5) |

| (10) | 10,000 | 2,000 | (8) |

|

-

|

-

| 500 | (11) |

|

-

| $82,100 |

-

|

-

|

|

debit transaction number

| DR | CR |

credit transaction number

|

|---|---|---|---|

| (6) | $10,000 | $2,000 | (7) |

|

-

| $8,000 |

-

|

-

|

|

debit transaction number

| DR | CR |

credit transaction number

|

|---|---|---|---|

| (4) | $4,000 |

-

|

-

|

|

-

| $4,000 |

-

|

-

|

|

debit transaction number

| DR | CR |

credit transaction number

|

|---|---|---|---|

| (2) | $2,400 |

-

|

-

|

|

-

| $2,400 |

-

|

-

|

|

debit transaction number

| DR | CR |

credit transaction number

|

|---|---|---|---|

| (5) | $20,000 |

-

|

-

|

|

-

| $20,000 |

-

|

-

|

|

debit transaction number

| DR | CR |

credit transaction number

|

|---|---|---|---|

| (3) | $50,000 |

-

|

-

|

|

-

| $50,000 |

-

|

-

|

|

debit transaction number

| DR | CR |

credit transaction number

|

|---|---|---|---|

| (8) | $2,000 | $4,000 | (4) |

|

-

|

-

| $2,000 |

-

|

|

debit transaction number

| DR | CR |

credit transaction number

|

|---|---|---|---|

|

-

|

-

| $40,000 | (3) |

|

-

|

-

| $40,000 |

-

|

|

debit transaction number

| DR | CR |

credit transaction number

|

|---|---|---|---|

|

-

|

-

| $10,000 | (10) |

|

-

|

-

| $10,000 |

-

|

|

debit transaction number

| DR | CR |

credit transaction number

|

|---|---|---|---|

|

-

|

-

| $100,000 | (1) |

|

-

|

-

| $100,000 |

-

|

|

debit transaction number

| DR | CR |

credit transaction number

|

|---|---|---|---|

|

-

|

-

| $10,000 | (6) |

|

-

|

-

| 5,000 | (9) |

|

-

|

-

| $15,000 |

-

|

|

debit transaction number

| DR | CR |

credit transaction number

|

|---|---|---|---|

| (11) | $500 |

-

|

-

|

|

-

| $500 |

-

|

-

|

Unadjusted Trial Balance Preparation

The unadjusted trial balance lists all of the general ledger accounts and the respective balances of each of the accounts, and is typically prepared at the end of each accounting period, typically monthly. The balances of each account in the general ledger are typically used as a source in preparing the trial balance.

The trial balance lists accounts in the order in which they appear in the ledger. All asset accounts are normally listed first, followed by liability, equity, dividends, revenue, and expense accounts. The primary purpose of the trial balance is to ensure the mathematical equality of debits and credits after posting has been completed. A trial balance can also help detect errors in journalizing and posting. Also, it assists in the preparation of financial statements. The trial balance does not, however, prove that a company has recorded all transactions or that the general ledger is correct.

| Unadjusted Trial Balance | ||

|---|---|---|

| Account | Debit | Credit |

| Cash | $82,100 |

-

|

| Accounts Receivable | 8,000 |

-

|

| Supplies | 4,000 |

-

|

| Prepaid Insurance | 2,400 |

-

|

| Truck | 20,000 |

-

|

| Equipment | 50,000 |

-

|

| Account Payable |

-

| $2,000 |

| Notes Payable |

-

| 40,000 |

| Unearned Revenue |

-

| 10,000 |

| Common Stock |

-

| 100,000 |

| Revenue |

-

| 15,000 |

| Utilities Expense | 500 | |

|

-

| $167,000 | $167,000 |

Adjustments

In order to ensure that a company has recorded revenues and expenses in the correct accounting period, various adjusting journal entries are required to be made at the end of the accounting period. Adjusting entries are typically recorded after the preliminary (or first) trial balance is prepared. Adjusting entries fall into two broad categories: deferrals and accruals.

Deferrals

Deferrals can be one of the following:

- Prepaid Expenses: Expenses paid for in cash and recorded as assets before they are used or consumed. Esentially, exchanging one asset (cash) for another.

- Unearned Revenues: Revenues received in cash and recorded as liabilities before they are earned.

The adjusting entries for deferrals are needed at month-end to record either the expense incurred (due to either the passage of time or through use and consumption) or the revenue that has been earned in the current accounting period. In the event that a company fails to record adjustments for deferrals, then the assets and liabilities are overstated and the corresponding expense and revenue accounts are understated.

Let's first look at two examples of prepayments in the adjusting entry below.

First, account of supplies reveals $3,200 on hand. If we were to look at the unadjusted trial balance, we would notice that we have supplies valued at $4,000. This means we must have used $800 during the month. So the answer would be to debit supplies expense for $800 and credit supplies, as they have decreased, for the $800 as well.

The other prepaid item we had was insurance. Remember when we purchased six months worth of insurance? We considered that an asset because someone owed us insurance. However, now that a month has passed, we have used up one of those months and they only owe us five months. So if we assume that each month costs the same, we take the $2,400 divided by six months and get $400 per month. So we would debit insurance expense for $400, and credit prepaid insurance for $400 as well.

Let's now look at an example of unearned revenue in the adjusting entry below.

In our example we have earned $4,000 of the unearned revenue. We can now debit the liability because we no longer owe them that $4,000, and credit the revenue account because because we have now earned it.

Accruals

Accruals can be one of the following:

- Accrued Revenues: Revenues that have been earned but not yet received in either cash or recorded in the accounting records.

- Accrued Expenses: Expenses that have been incurred but not yet paid in cash or recorded in the accounting records. Another name for Accrued Expenses is Accrued Liabilities. Remember, this is a liability account on the Balance Sheet.

The adjusting entries for accruals are needed at month-end to record unrecognized revenues earned and expenses incurred in the current accounting period. In the event that a company fails to record adjustments for accruals, then either the revenue account (and related asset account) or the expense account (and the corresponding liability account) are understated. As a result, adjusting entries for accruals will increase both a balance sheet and an income statement account.

Let's look at two examples of accruals in adjusting entry below.

Remember we took out a note when we purchased the equipment. Although we will not pay this note today, we have had the note for the last month and, therefore, have used up one month of interest expense.

One month of interest would be found by taking the note, $40,000, times the interest rate, 5%, times 1 over 12 because we've had the loan for one month. If it were two months, it would be 2 out of 12. We get then $166.67. So we would debit interest expense for that amount and credit interest payable because we now owe that amount in interest.

The last adjusting entry, then, is that of an accrued revenue. This is where we have earned revenue but have not billed the client or been paid for it. Is it a revenue, then? Yes, because, again, we recognize revenues when we earn them.

So even though we haven't billed the client, we can still debit accounts receivable because they still owe us, whether we sent the bill or not. We performed the service, we will eventually bill them, so they certainly owe it to us. We'll debit accounts receivable and then credit the revenue account because, again, we have earned the revenue.

| Adjusting Journal Entry | |||||

|---|---|---|---|---|---|

| Adjusting Transaction # | Date | Account | Ref. | Debit | Credit |

|

-

| Dec. |

-

|

-

|

-

|

-

|

| 1 | 31 | Supplies Expense | 343 | $800 |

-

|

|

-

|

-

|

Supplies

| 103 |

-

| $800 |

|

|

| (to record supplies used) |

|

|

|

| 2 | 31 | Insurance Expense | 342 | 400 |

-

|

|

-

|

-

|

Prepaid Insurance

| 105 |

-

| 400 |

|

|

| (to record insurance expired) |

|

|

|

| 3 | 31 | Unearned Revenue | 204 | 4,000 |

-

|

|

-

|

-

|

Revenue

| 331 |

-

| 4,000 |

|

|

| (to record revenue earned) |

|

|

|

| 4 | 31 | Interest Expense | 346 | 167 |

-

|

|

-

|

-

|

Interest Payable

| 205 |

-

| 167 |

|

|

| (to record interest accrued) |

|

|

|

| 5 | 31 | Accounts Receivable | 102 | 1,000 |

-

|

|

-

|

-

|

Revenue

| 331 |

-

| 1,000 |

|

|

| (to record revenue earned) |

|

|

|

| 6 | 31 | Depreciation Expense, Equipment | 347 | 9,600 |

|

|

|

|

Accumulated Depreciation, Equipment

| 110 |

| 9,600 |

|

|

| (to record depreciation expense, equipment) |

|

|

|

| 7 | 31 | Depreciation Expense, Truck | 348 | 5,000 |

|

|

|

|

Accumulated Depreciation, Truck

| 111 |

| 5,000 |

|

|

| (to record depreciation, Truck) |

|

|

|

Adjusted Trial Balance

After all adjusting entries have been journalized and posted to the appropriate ledger accounts, a company prepares another trial balance from the general ledger accounts referred to as the adjusted trial balance.

| Adjusted Trial Balance | ||

|---|---|---|

| Account | Debit | Credit |

| Cash | $82,100 |

-

|

| Accounts Receivable | 9,000 |

-

|

| Supplies | 3,200 |

-

|

| Prepaid Insurance | 2,000 |

-

|

| Truck, net | 15,000 |

-

|

| Equipment, net | 40,400 |

-

|

| Account Payable |

-

| $2,000 |

| Interest Payable |

-

| 167 |

| Notes Payable |

-

| 40,000 |

| Unearned Revenue |

-

| 6,000 |

| Common Stock |

-

| 100,000 |

| Revenue |

-

| 20,000 |

| Depreciation Expense (Equipment) | 9,600 |

|

| Depreciation Expense (Truck) | 5,000 |

|

| Utilities Expense | 500 |

-

|

| Supplies Expense | 800 |

-

|

| Insurance Expense | 400 |

-

|

| Interest Expense | 167 | |

|

-

| $168,167 | $168,167 |

Statement Preparation

Financial statements are normally prepared directly from the account balance information contained in the adjusted trial balance. The statements include the following:

- Income Statement

- Statement of Retained Earnings

- Balance Sheet

Income Statement

| Revenues |

-

|

-

|

|

Revenue

|

-

| $20,000 |

| Expenses |

-

|

-

|

|

Utilities Expense

| $500 |

-

|

|

Supplies Expense

| 800 |

-

|

|

Insurance Expense

| 400 |

-

|

|

Interest Expense

| 167 |

-

|

|

Depreciation Expense, Equipment

| 9,600 |

|

|

Depreciation Expense, Truck

| 5,000 |

|

| Total Expenses |

-

| 16,467 |

| Net Income |

-

| $3,533 |

Statement of Retained Earnings

| Retained Earnings 12/1/20XX |

-

| $0 |

| Add: Net Income |

-

| +$3,533 |

| Less: Dividends |

-

| 0 |

| =Retained Earnings 12/31/20XX |

-

| $3,533 |

Balance Sheet

| Assets |

-

| Liabilities |

-

|

| Cash | $82,100 |

Accounts Payable

| $2,000 |

|

Accounts Receivable

| 9,000 |

Notes Payable

| 40,000 |

|

Supplies

| 3,200 |

Interest Payable

| 167 |

|

Prepaid Insurance

| 2,000 |

Unearned Revenue

| 6,000 |

| Total Current Assets | $96,300 | Total Liabilities | $48,167 |

|

Truck

| 15,000 | Owners' Equity |

-

|

|

Equipment

| 40,400 |

Common Stock

| 100,000 |

| Total PP&E | $55,400 |

Retained Earnings

| 3,533 |

| Total Assets | $151,700 | Total Owners' Equity | $103,533 |

|

-

|

-

| Total Liabilities & Owners' Equity | $151,700 |

Closing Process

The closing process zeros out the balances in all temporary accounts (revenue, expense, and dividend accounts), in order to prepare the recording and posting of transactions for the new accounting period. For example, Amazon.com would need to close the revenue and expenses on the income statement each year so that when a new year starts, the new revenue and the new expenses for the new year can start to be accumulated. Balances in these temporary accounts are transferred to a clearing account titled income summary. The sole purpose of this income summary account is to facilitate the closing process of the temporary accounts.

Only revenue and expense accounts are "closed out" to income summary while dividends are closed directly to retained earnings. The income summary account, as the name suggests, shows us our net income or loss and will be exactly the same as the net income/loss on the income statement, which also does not include dividends. The balance in the income summary account is also closed out directly to retained earnings.

Let's look at how to prepare closing entries.

| Closing Entries | |||||

|---|---|---|---|---|---|

| Transaction Number | Date | Account | Ref. | Debit | Credit |

| 1 | 20XX | Revenue | 331 | $20,000 |

-

|

|

-

| Dec.31 |

Income Summary

| 350 |

-

| $20,000 |

The first step in the closing process is to close all revenues. Revenues increase owner's equity, so they would have a credit balance. To get rid of them or taken down to zero then, we would debit them. So we would debit revenues and credit income summary. In our example, we only have one revenue account. So we will debit revenue $20,000 and credit income summary for $20,000 as well.

| Closing Entries | |||||

|---|---|---|---|---|---|

| Transaction Number | Date | Account | Ref. | Debit | Credit |

| 2 | 20XX | Income Summary | 350 | $16,467 |

-

|

|

-

| Dec.31 |

Utilities Expense

| 345 |

-

| $500 |

|

-

|

-

|

Supplies Expense

| 343 |

-

| 800 |

|

-

|

-

|

Insurance Expense

| 342 |

-

| 400 |

|

-

|

-

|

Interest Expense

| 346 |

-

| 166.67 |

|

|

|

Depreciation Expense, Equipment

| 347 |

| 9,600 |

|

|

|

Depreciation Expense, Truck

| 348 |

| 5,000 |

The second step in the process is to close all expenses. Expenses decrease owner's equity, so they would have a typical debit balance. So to get rid of them or take them to zero, we would credit them. So we will debit income summary, leave that blank for now, and credit all the expenses. Once we get a total of all the expenses, that's what we will debit to income summary.

So in our example, we have six expenses, utilities expense of $500, supplies expense of $800, insurance expense of $400, interest expense of $166.67, depreciation expense (equipment) for $9,600 and depreciation expense (truck) of $5,000. So if we total them then, it comes to $16,467. And that's what we will debit to income summary.

| Closing Entries | |||||

|---|---|---|---|---|---|

| Transaction Number | Date | Account | Ref. | Debit | Credit |

| 3 | 20XX | Income Summary | 350 | $3,533 |

-

|

|

-

| Dec.31 |

Retained Earnings

| 313 |

-

| $3,533 |

The third step in the process is the only step that doesn't have a specific rule. We do know that the third step will always contain income summary and retained earnings. Which one is debited and which one is credited, however, can change. In this case, we debited income summary for the expenses of $16,467 and credited it for the revenues of $20,000. So we have a credit balance of $3,533.

To get rid of that then, we would debit income summary for that amount and credit retained earnings for that same amount. Had we lost money or had more expenses and revenues, this transaction would be reversed. We would debit retained earnings and credit income summary.

Post-Closing Trial Balance

Once the closing entries have been journalized and posted, a third trial balance may be prepared. It is called the post-closing trial balance. Since all of the temporary accounts now have zero balances as a result of the closing process, only permanent accounts (asset, liability, and equity account balances other than dividends) should appear on the post-closing trial balance. The post-closing trial balance is the last step in finalizing the accounting period prior to recording business transactions in the next accounting period (often the next month).

| Post-Closing Trial Balance | ||

|---|---|---|

| Account | Debit | Credit |

| Cash | $82,100 |

-

|

| Accounts Receivable | 9,000 |

-

|

| Supplies | 3,200 |

-

|

| Prepaid Insurance | 2,000 |

-

|

| Truck | 15,000 |

-

|

| Equipment | 40,400 |

-

|

| Account Payable |

-

| $2,000 |

| Interest Payable |

-

| 167 |

| Notes Payable |

-

| 40,000 |

| Unearned Revenue |

-

| 6,000 |

| Common Stock |

-

| 100,000 |

| Retained Earnings | 3,533 | |

|

-

| $151,700 | $151,700 |

It should be noted that the post-closing trial balance provides evidence that a company has properly recorded the journal entries and posted the closing entries. However, none of the trial balances (preliminary, adjusted or post-closing) are foolproof because they do not prove that the company has recorded all transactions or that the general ledger is correct. For example, the post-closing trial balance will still be in balance if a transaction has not been recorded and posted to the ledger, or if a transaction is recorded and posted twice in error.

Terminology Self-Check

This might be a good time to review some of the terms we used in this lesson.