Main Content

Lesson 1: Introduction to Financial Statements

The Statement of Changes in Stockholders’ Equity | Video

The statement of changes in stockholders’ equity, as the name implies, reports any changes that have occurred in the components of equity. Often, it is called the statement of owners’ equity, or statement of stockholders’ equity if the company is a corporation. Three elements of FASB’s conceptual framework are found in this financial statement:

- Investments by owners: Transfers, usually cash, from owners to the company. Owners invested $50,000 in Robyn's Retail, which we have called common stock. Owners' investments increase contributed capital, which is part of equity, though not explicitly labeled as such. Common stock is contributed capital.

- Net income: Amounts generated through transactions with nonowners. In our discussion of the income statement, we saw that Robyn's Retail had transactions with customers to earn revenue, and with suppliers to purchase various items, resulting in net income of $1,292. Net income is an addition to equity each period. If there were a net loss, it would decrease equity.

- Distributions to owners: Transfers, usually cash, from the company to its owners. Cash dividends are distributions to owners, and these distributions decrease equity.

The accumulation of net income over the years, minus any distributions to owners, is called retained earnings. A statement of stockholders' equity shows changes in retained earnings by adding net income and subtracting dividends.

| Robyn's Retail | |||

| Statement of Shareholders' Equity | |||

| For the month ended September 30, 20xx | |||

| Common Stock | Retained Earnings | Total SE | |

| September 1, 20XX | $ - | $ - | $ - |

| Contribution by Owners | 50,000 | 50,000 | |

| Net Income | 1,292 | 1,292 | |

| Dividends | 0 | 0 | |

| September 30, 20XX | $ 50,000 | $ 1,292 | $ 51,292 |

Please watch to learn more about the statement of changes in owners' equity.

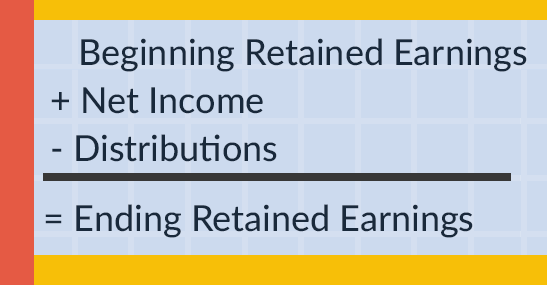

As noted, changes in retained earnings are shown in the statement of owners' equity. It is important to highlight the formula for retained earnings (Figure 1.2):

In a corporation, distributions to owners (stockholders) are called dividends. Always remember that distributions (dividends) are not reported in net income. In other words, distributions are not an expense and are not subtracted from revenues to arrive at net income. Rather, dividends are a direct reduction from retained earnings; they never pass through net income.