Main Content

Lesson 1: Course Expectations and Research

Steps in the Accounting Process, Adjusting Entries, and Errors

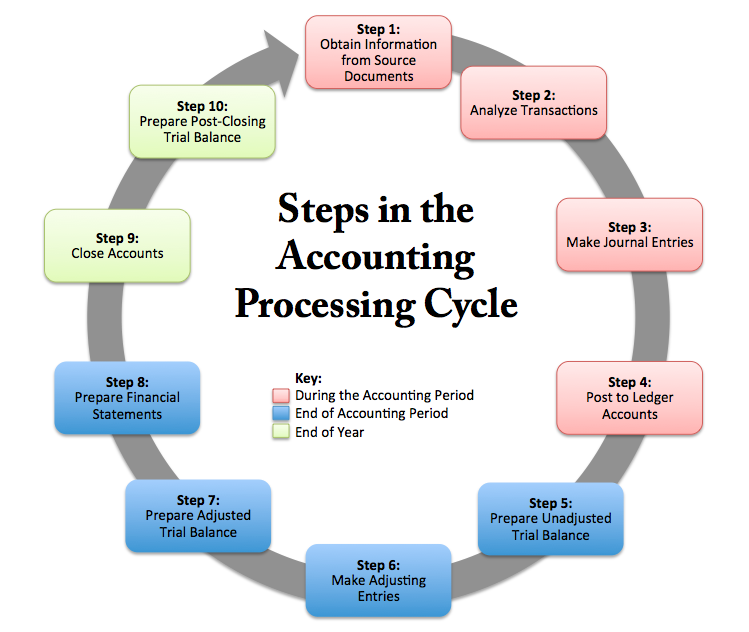

Next, the steps of the accounting processing cycle, shown in Exhibit 2, are the systems used to ensure that transactions are properly recorded. We will test this process during the audit, as well as the related system of internal control associated with the process.

Exhibit 2. Steps in the Accounting Processing Cycle

Exhibit 3 serves as a reminder of the formal link between the income statement accounts and the balance sheet accounts. Notice the effects, as indicated by the arrows, can be direct or indirect.

Exhibit 3. Adjusting Entries

We express the impact of a misstatement (error) in the accounting records in terms of an overstatement or understatement. I suggest that you adopt this method of analysis and expression. Experience has shown that it helps students apply the auditing concepts and procedures more easily and completely.

Exhibit 4 is an example of an error. The 2010 Ending Inventory overstates net income. Exhibit 4 shows the error corrects itself in 2011. This is unacceptable for audit purposes.

Audit procedures are specifically designed to identify this type of error, determine the circumstances, intentional or unintentional, that allowed the misstatement to occur and propose the audit adjusting journal entry to the company that would correct net income for 2010. Without the correction, 2010 net income would be overstated.

Exhibit 4. Inventory Misstatement Example

|

The SitTite Chair Company uses a periodic inventory system. A mathematical error in 2010 caused a $250,000 overstatement of the ending inventory. However, future inventories were correctly calculated. The proper course of action for correcting this error depends on when the error was discovered. The figures below, which ignore income tax, show the effects of the error if discovered after 2011. In each instance, the overstated and understated amounts are $250,000. Analysis: U= Understated O = Overstated |

|||

| 2010 | 2011 | ||

|

Beginning inventory Retained earnings |

|

Beginning inventory Retained earnings | O - $250,000 O - $250,000 O - $250,000 U - $250,000 corrected |