Main Content

Lesson 1: Course Orientation and Defining Managerial Accounting

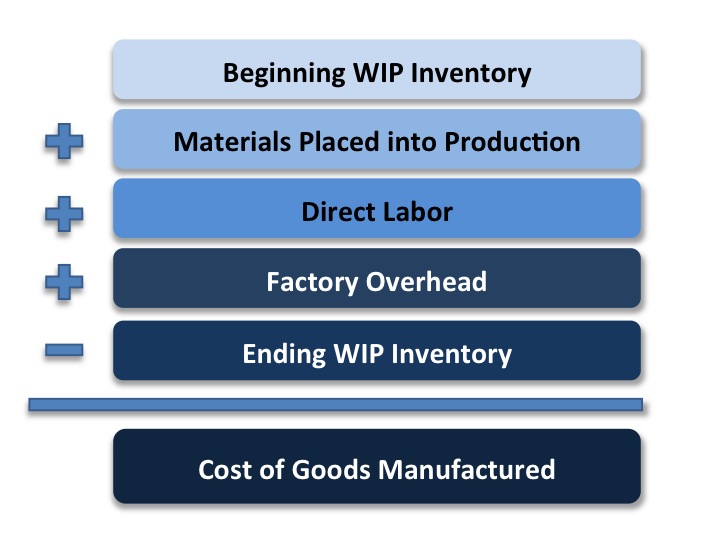

Step 2: Cost of Goods Manufactured

The next step in calculating COGS is to determine the cost of goods manufactured (COGM). This is the goods that have been completed. You find this by using the work in process inventory (WIP). WIP inventory is the amount of product that has been started but not yet completed. To WIP inventory, add the entire product costs, which included direct materials (which you found from the previous formula), direct labor and factory overhead. The formula for COGM is shown in Formula 1.2.

|

Guided Example

For your example, the COGM is shown below.| Beginning WIP Inventory | $ 200,000 | |

| + | Materials Placed into Production | + $ 780,000 |

| + | Direct Labor | + $ 300,000 |

| + | Factory Overhead | + $ 150,000 |

| - | Ending WIP Inventory | - $ 300,000 |

| Cost of Goods Manufactured | $ 1,130,000 | |